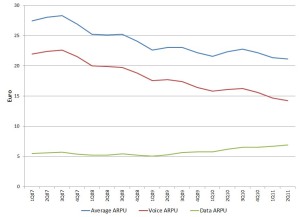

The numbers for mid-2011 are in and the big picture for mobile network operators is clear: overall ARPUs continue to decline led by declining voice service revenue. Data service revenue continues to grow, but not at a sufficient rate to compensate for the decline in voice revenue. In fact, data services which on average constitutes a about a third of ARPU fail to stabilize ARPU and hold off the erosion.

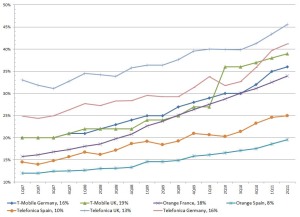

For the operators surveyed, which include major service providers such as Vodafone, Deutsche Telekom, Telefonica, and France Telecom, ARPU in their Western European operations fell 23% on average from 2007. Voice revenue fell by 35% while data revenue increased by 25%. The average ARPU is 21€ of which 14€ is voice and 7€ is data. In comparison, Japanese operators have reported over 50% of revenue now comes from data services.

It’s not lost on to me that each service provider has different operating conditions and environment. For example, Telefonica has had the highest level of ARPU erosion due to poor macro-economic conditions and price competition in Spain. Furthermore, the number of subscribers did increase by 19% since 2007: these latest additions are lower ARPU subscribers. Yet, averages and trends point fundamentally to an eroding business case particularly as subscriber growth has leveled off in the last year or two.

Let’s be straight to the point: new sources of revenue are critical. Instead, operators are facing large investments: new spectrum acquisition and migration to LTE with all the infrastructure upgrade it entails. Billions need to be channeled into new infrastructure. Acquiring new subscribers has become a zero-sum game with ever increasing costs. That’s why in the big picture, MNOs would rather hold off on rolling out LTE as much as possible and leverage the existing 3G infrastructure to the maximum.

So, it will be a huge mistake for MNOs not to actively look for new sources of revenue as well as for new techniques to minimize heavy expenditures. It’s time to think out of the box which is no small feat for huge conglomerates. In the end, mobility service is an infrastructure service like electricity and water. These older utilities continue to leverage an archaic infrastructure built mostly in the early 20th century. Unfortunately for MNOs this is not a possibility as innovation in consumer devices and applications continue to drive the need for higher bandwidth at ever lower prices. Hence the dilemma of the wireless operator.