The 2.5 GHz LTE auction in Brazil came to an end last week with total proceedings of 2.96 Billion Real ($1.42 Billion). The spectrum included a sliver of 450 MHz spectrum for rural access which regulator Anatel was not able to auction independently and was later included with the 2.5 GHz licenses.

The 2.5 GHz band was divided into five FDD sub-bands and two TDD sub-bands as per the band plan below. The 450 MHz was coupled on a regional basis.

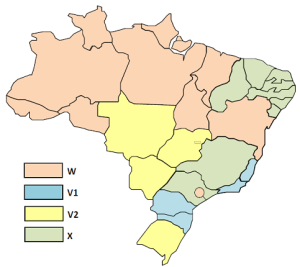

Telefonica (under brand Vivo) was the biggest spender acquiring a 2×20 MHz license in 2.5 GHz which in addition to the 14 MHz regional 450 MHz license came to $508 million, or $0.049 per MHz-PoP. This was 67% over the minimum price for this sub-band. Claro (America Movil) acquired the second 2×20 MHz license for $409 million, or $0.039 per MHz-PoP. This was 34% over the minimum price. Telecom Italia and Oi (partly owned by Portugal Telecom) spent just over $160 million each on a pair of 2×10 MHz licenses

| Company |

Band |

Bandwidth (MHz) |

Price |

$/MHz-PoP |

|

|

Real |

USD |

||||

| Claro (América Móvil) |

W |

2 x 20 |

844,519,000 |

409,186,346 |

0.039 |

| Vivo (Telefónica) |

X |

2 x 20 |

1,050,000,000 |

508,746,000 |

0.049 |

| Telecom Italia Mobile |

V1 |

2 x 10 |

340,000,000 |

164,736,800 |

0.025 |

| TNL (Oi) |

V2 |

2 x 10 |

330,851,000 |

160,303,927 |

0.025 |

| Total |

2.5 GHz: 2 x 60 450 MHz: 2 x 7 |

2,565,370,000 |

1,242,973,072 |

0.048 |

|

| Price includes 2×7 MHz regional license in 450 MHz. It is implicit in the results that this band was heavily discounted. | |||||

While the prime FDD sub-bands fetched 87.5% of the total value of spectrum, the 2 x 5 MHz P sub-band fetched 254 million Real ($123 million), or 8.7% of the auction total. The TDD U band fetched 109 million Real ($53 million) or 3.7% of the auction total (won by Sky and Sunrise on regional basis).

The results of this spectrum auctions are generally in line with those for the 2.5 GHz seen in Europe:

| Auction/Date |

$/MHz-PoP |

| Sweden (8/2008) |

0.16 |

| France (9/2011) |

0.106 |

| Italy (9/2011) |

0.059 |

| Belgium (11/2011) |

0.046 |

| Spain (8/2011) |

0.027 |

| Germany (8/2010) |

0.023 |

Overall, the auction brought in 31.7% more revenue than the minimum bid prices set by Anatel and can be considered a success. The trend continues for the dominant players in a market (Vivo & Claro) to acquire a larger allocation of spectrum as seen in other countries.

Pingback: Telecom Operator News » Analysis of Brazil's 2.5 GHz Spectrum Auction Results « Frank Rayal

Pingback: Analysis of Brazil's 2.5 GHz Spectrum Auction Results « Frank Rayal | Telecom Carriers

Pingback: Analysis of Brazil's 2.5 GHz Spectrum Auction Results « Frank Rayal | Telecom Operator News

Pingback: Analysis of Brazil's 2.5 GHz Spectrum Auction Results « Frank Rayal | Mídia Global

Pingback: Analysis of Brazil's 2.5 GHz Spectrum Auction Results « Frank Rayal | Telecom Carriers