If you’re in the wireless infrastructure business, you’ve seen it many, many times. I’m talking about the predictions showing exponential mobile data traffic growth. Hardly a conference presentation goes by without seeing this graph on the first or second slide. It became customary to preface any discussion with this context, often with the idea to get people salivating at a potential windfall of profits from selling systems, software, or services. But predictions are tricky, and mobile data predictions are particularly tricky. A sober read of the facts and what’s behind the headlines is revealing.

If you’re in the wireless infrastructure business, you’ve seen it many, many times. I’m talking about the predictions showing exponential mobile data traffic growth. Hardly a conference presentation goes by without seeing this graph on the first or second slide. It became customary to preface any discussion with this context, often with the idea to get people salivating at a potential windfall of profits from selling systems, software, or services. But predictions are tricky, and mobile data predictions are particularly tricky. A sober read of the facts and what’s behind the headlines is revealing.

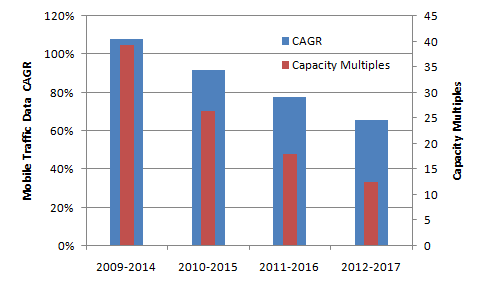

Let’s have a look at Cisco’s latest VNI was released earlier last month. It includes a significant reduction in estimated mobile data traffic of about a third for 2012-2016 from those estimated a year ago (29% reduction for 2012). Cumulative average growth rate drops from 78% (18x) to 66% (13x) for the 5-year period ending 2016 and 2017, respectively. Mobile data growth, although still substantial, is not as high as we thought it is, and it is continuously being downgraded every passing year. Predicting data growth is tough business.

Cisco’s data tracks mobile data traffic exclusive of offload traffic to WiFi. But WiFi offload has particularly been a major growth area. I had the opportunity to speak with a few providers of carrier-WiFi solutions at MWC and, if anything is clear, it is that demand is white hot. I also had the opportunity to see a demonstration of seamless handover between WiFi and 3G by Qualcomm, a feature that will be supported in 3GPP Release 12. Walking around Barcelona, I could not help but notice the ‘small cells’ mounted on traffic light or other low height, light structures (some with their wireless backhaul as well). That’s why I think small cells are here today – and they are WiFi!

Another important issue related to data is to look at who’s using what and how. Consider this example. Today’s youth are well connected. Many under 18 have Facebook accounts even as that is against company regulations. They have plenty of time on their hands, like to text each others, share photos, and watch a lot of video: social networking and entertainment are primary applications. Their parents on the other hand have much less time to spare; they use less bandwidth in applications such as email, voice, web browsing and other narrow-band data applications. Two things emerge from this example: 1) narrow-band applications are of high value; and 2) the heaviest data users are low-value customers! Why not simply throttle them through tiered pricing plans?

What does this all mean?

I think that operator strategies will continue to focus on expanding offload strategies, implementing pricing strategies to moderate data consumption and implement specific technologies to manage certain high bandwidth applications such as video. Only then can they limit their costs to maintain (or unfortunately in many markets reach) profitability.

I guess the telcos have to rework their pricing plan & strategies.

Yes – this is already happening. According to Cisco the percentage of tiered plans compared to all data plans increased from 4 percent to 55 percent, while unlimited plans dropped from 81 percent to 45 percent over the last three years…