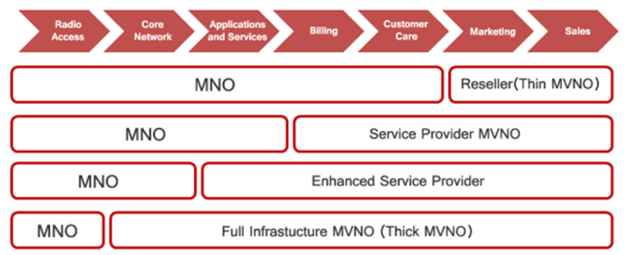

The wireless market in Canada is on the cusp of changes due to new regulations that open the market for a new breed of MVNO services. Full MVNOs are now possible: they will be able to have their own mobile network codes (MNCs) and provision their own IMSI numbers. Full MVNOs own their core network including all subscriber related entities (HLR or HSS, etc.) while relying on wholesale service provider for the radio access network only. This makes these MVNOs independent at least from a retail perspective from the underlying host wireless carrier. MVNOs will be able to make arrangements with multiple wireless carriers and negotiate their own roaming arrangements with other national and international carriers. However, the regulator stopped short of mandating MVNO models, leaving it in the hands of incumbent MNOs. So the question remains: will these new rules stimulate the market and allow greater vitality in what is now a dull MVNO landscape?

The wireless market in Canada is on the cusp of changes due to new regulations that open the market for a new breed of MVNO services. Full MVNOs are now possible: they will be able to have their own mobile network codes (MNCs) and provision their own IMSI numbers. Full MVNOs own their core network including all subscriber related entities (HLR or HSS, etc.) while relying on wholesale service provider for the radio access network only. This makes these MVNOs independent at least from a retail perspective from the underlying host wireless carrier. MVNOs will be able to make arrangements with multiple wireless carriers and negotiate their own roaming arrangements with other national and international carriers. However, the regulator stopped short of mandating MVNO models, leaving it in the hands of incumbent MNOs. So the question remains: will these new rules stimulate the market and allow greater vitality in what is now a dull MVNO landscape?

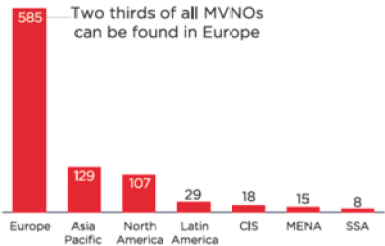

These regulations promise a change in a market that’s largely controlled by incumbent wireless carriers but stop short of radical change in the competitive landscape. Efforts to stimulate competition with new entrants have so far not paid of: incumbents own 95 % of subscribers and have gobbled up two out of the four new entrants. Spectrum concentration remains largely in the hand of incumbents while new entrants possessing limited spectrum allocations. The largest of the new entrants, Wind, sat out two of the three recent auctions. Without mandating MVNO services and obliging the large carriers to strike such agreements the market is likely to remain in ‘statico.’

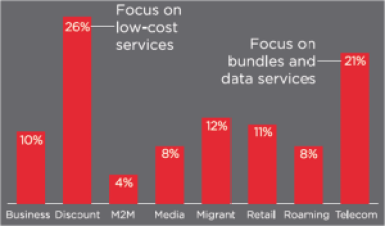

Should certain MVNOs be successful in establishing a service agreement, the question shifts to how they will structure their operations and what segments they would target. Technologies such as SDN/NFV allows full MVNOs to operate on a scalable model which promises lower cost-base and higher flexibility and agility to support new features and services than legacy networks. MVNOs have the option to leverage multiple radio access networks and would not be restricted to one underlying access technology. Wi-Fi can be used as much as 3G or LTE small or macro cells. This gives full MVNOs greater ability to target a wide range of market segments which is not limited to the consumer segment but expands to include commercial applications in automotive, health, and many other sectors.

From our side at Xona Partners, we have focused on developing MVNOs that are optimized to run IoT-based services by taking advantage of: 1. the virtualized and cloud-based mobile core and backend systems; 2. the data-centric overlay models that run over 3G/4G and Wi-Fi in addition to developing IoT access technologies that optimize resources according to various application requirements, and; 3. the data-centric platforms which leverage advanced data sciences and analytics models that have direct benefits as a service or as an integral part of the business model of the MVNO. These activities take advantage of the latest developments in mobile network architecture, mobile device design and overall Internet business model evolution.

MVNOs in the smartphone era have focused on offering similar services as those offered by the MNOs while optimizing cost models, customer segmentation and branding/marketing for differentiation. As we move into the IoT era, we believe that MVNOs have the opportunity to develop IoT-centric application models that are significantly different from what the MNOs can themselves offer in a comparable time frame. As such, MVNOs are becoming closer to over-the-top (OTT) model with inherent advantages in scale, agility and flexibility.