The 700 MHz auction in France closed last week raising a total of €2.8 billion ($3.17 billion). Orange and Free Mobile secured 2 block of 5 MHz duplex spectrum, while Bouygues and SFR secured one 5 MHz block each. The operators will have now to bid for the position of the allocation in the band: they got four choices, so the price will go up. In this second bid process, the second and third choice placements cost 2/3rd and 1/3rd the price of the winning bid, respectively. The operator left with the last choice pays nothing.

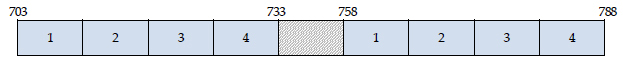

The 700 MHz auction in France closed last week raising a total of €2.8 billion ($3.17 billion). Orange and Free Mobile secured 2 block of 5 MHz duplex spectrum, while Bouygues and SFR secured one 5 MHz block each. The operators will have now to bid for the position of the allocation in the band: they got four choices, so the price will go up. In this second bid process, the second and third choice placements cost 2/3rd and 1/3rd the price of the winning bid, respectively. The operator left with the last choice pays nothing.

Fig 1. Placements options in the 700 MHz blocks.

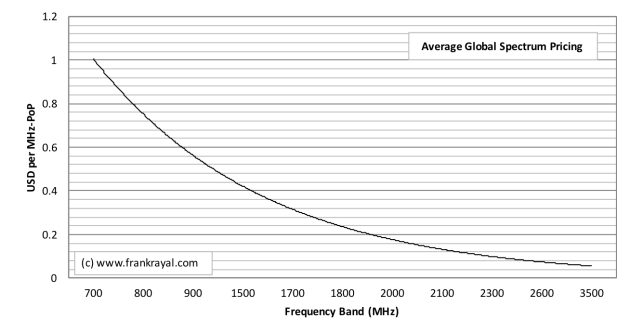

While awaiting the final tally, the cost of the French auction stands at €0.7 per MHz-PoP ($0.8). This is much higher than Germany’s €0.21 per MHz-PoP ($0.23). It reflects a more competitive environment created by Free. In fact, the auction exceeded the anticipated value by ARCEP. In North America, 700 MHz has fetch even higher valuations. In last year’s auction in Canada, 700 MHz went for just under $2 per MHz-PoP. US 700 MHz valuation ranges widely as seen in auctions and secondary market activities, many of which included prime markets. T-Mobile paid $1.85 per MHz-PoP for Verizon’s A-block (acquired for $1.47 at auction). AT&T paid $4.29 for Verizon’s B-block (18 states including markets like LA, Miami, Chicago).

Fig. 2. Average global spectrum pricing.