Auction 97 for the AWS-3 band made headline news as operators spent $44.9 billion on 65 MHz of spectrum – a huge sum of money. But what’s behind the headline story; what do the numbers tell? Here are some of observations:

Auction 97 for the AWS-3 band made headline news as operators spent $44.9 billion on 65 MHz of spectrum – a huge sum of money. But what’s behind the headline story; what do the numbers tell? Here are some of observations:

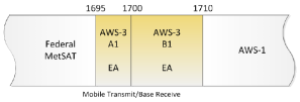

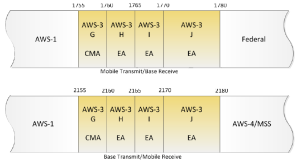

* There were 1611 licenses to be had covering 65 MHz of spectrum of which 50 MHz is FDD (J, I, H, and G blocks) and 15 MHz is TDD (A1 and B1 blocks).

* The most valuable block is the J block which is 2 x 10 MHz wide, followed by I and H blocks with 2 x 5 MHz. The G block, which is also 2 x 5 MHz, sits at the edge of the band and is perceived of slightly lower value (actually it came at 12% discount from the I and H blocks!).

* The “J” block fetched 41% of the total proceeds, followed by the I and H bands with 19% of proceeds each. The G block managed to fetch 17%. This leaves only 5.4% of value for the TDD blocks! There’s a premium for wide channel bandwidth commensurate with higher spectral efficiency which is reflected in the pricing (which actually amounts to 8%).

* Dish did win the lion share of the outstanding licenses: 702 in all. But 324 are for the A1 & B1 TDD blocks; and they only managed 7 “J” licenses and 72 I and H licenses. The total spend on “J” blocks was $381.6 million (3% of gross spend) and on “I” and “H” bands is close to $5 billion (37% gross spend). The bulk of Dish spending was on “G” band licenses which amounted to over $5.9 billion (44% of total gross spend).

* On the other hand, AT&T, Verizon, and T-Mobile did not bid on the A1 and B1 blocks. AT&T walked away with 114 of the 176 “J” blocks for $10.2 billion (56% of spend) followed by Verizon with 48 “J” blocks for $7.54 billion (72% of spend).

* AT&T paid over $18 billion, or 41% of gross proceeds followed by Dish with $13 billion pre-discounts for 30% of gross proceeds. Verizon follows with $10.4 billion of gross proceeds. These three players account for 93% of total proceeds.

* The average price in this auction came at about $2.19 per MHz-PoP.

* There was intense competition for spectrum in the major markets with normalized price reaching more than double the average.

| Market | Winning Bid ($) | Bandwidth | $/MHz-PoP | |

| AT&T | New York | 2,762,964,000 | 2 x 10 MHz | 5.10 |

| Los Angeles | 1,843,601,000 | 2 x 10 MHz | 4.54 | |

| Chicago | 1,239,914,000 | 2 x 10 MHz | 5.73 | |

| Verizon | Los Angeles | 2,061,515,000 | 2 x 10 MHz | 5.07 |

| Washington DC | 966,958,000 | 2 x 10 MHz | 4.88 | |

| San Francisco | 783,427,000 | 2 x 10 MHz | 3.88 | |

| Dish | New York | 2,601,105,000 | 2×10 MHz | 4.80 |

| Chicago | 1,149,685,000 | 2 x 10 MHz | 5.31 | |

| New York | 829,167,000 | 2 x 5 MHz | 3.68 | |

| T-Mobile | Houston | 262,909,000 | 2×5 MHz | 3.57 |

| Miami | 200,686,000 | 2 x 5 MHz | 5.07 | |

| Phoenix | 136,268,000 |

2 x 5 MHz |

3.40 | |

| Italics denote G block (CMA – Cellular Market Area) | ||||

* In the AWS auction 66 the most expensive licenses was priced at $1.59 per MHz-PoP. The most expensive license in this auction is 4x that price. This reflects the level of competition in this auction. Not much new spectrum is expected to come on the market – the next one being the broadcast spectrum.

* There is much credence to those who say Dish’s aim is to eventually sell these licenses because you can’t build a nation-wide network out of these assets. I tend to agree as Dish walked away with many licenses that are not as valuable as those won by AT&T and Verizon.

Update – February 20, 2015: Verizon held an investor call to discuss the spectrum results. Good insights in their presentation.

Pingback: Mobile Edge Compute, The Threat of OTT and Changing Infrastructure Architecture | Frank Rayal

Pingback: 600 MHz Incentive Auction Key Facts | Frank Rayal